Is there a rule about keeping our nonprofit bank account under $25,000?

A homeschool treasurer asks if there is a limit to how much money can be in their checking account.

A homeschool treasurer asks if there is a limit to how much money can be in their checking account.

How a homeschool group can "self declare" its tax exempt status.

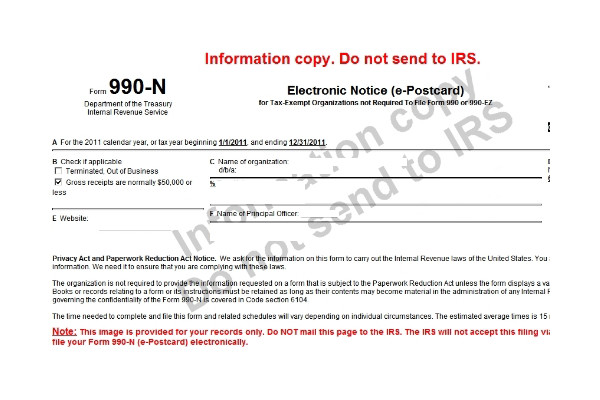

There is a new website for filing the IRS ePostcard, Form 990-N

The story of a small homeschool support group that grew into a full-fledged nonprofit organization

Homeschool leader cannot find her group in the IRS database of exempt organizations.

A lot of small organizations have learned that their tax exempt status had been revoked and they didn’t even know about it!

Here's a list of important papers to pass down to the future homeschool leaders of your organization.

Your homeschool group should be filing some reports every year with the IRS. Did you know that?

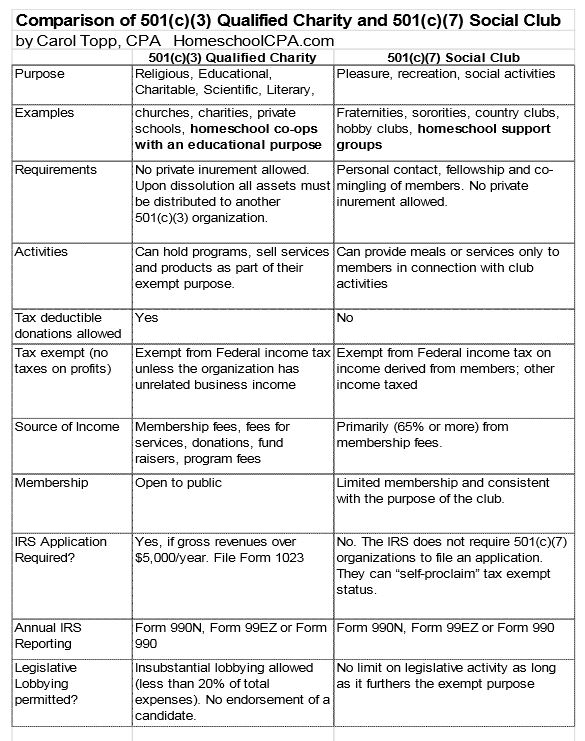

One difference between a homeschool co-op and support group is their tax exempt status in the eyes of the IRS.

Does getting an EIN mean you must file a return with the IRS?