Lots of small homeschool nonprofits find themselves in a awkward situation.

Their tax exempt status was revoked by the IRS and they didn’t even know it! Now they wonder how they can get tax exempt status back.

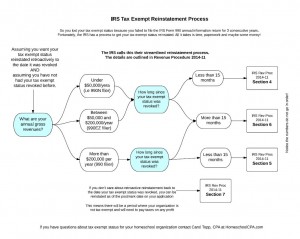

The IRS recently introduced a “streamlined” process to get tax exempt status reinstated. It’s all explained in IRS Rev Proc 2014-11 if you like reading IRS documents!

What the IRS calls “streamlined” means they went from a snail’s pace to a turtle’s pace! This new procedure still involves a lot of paperwork (the IRS loves paper) and paying an application fee. It may also include back filing the Form 990 Information returns you failed to file.

I created a flowchart to explain the process in pictures. I hope it helps.

Download my visual explanation of the IRS Rev Proc 2014-11 Streamlined Reinstatement Process as a pdf document

This 90 minute webinar 501c3 Application for Homeschool Nonprofits will explain the pros and cons of tax exempt status, what is needed before applying for tax exempt status, the cost and steps to take, and an explanation of the IRS Form 1023-EZ line-by-line. All created for homeschool groups by CPA Carol Topp.

Carol Topp, CPA

HomeschoolCPA.com