Taxes for Classical Conversations Directors

Help with taxes for Classical Conversations Directors.

Help with taxes for Classical Conversations Directors.

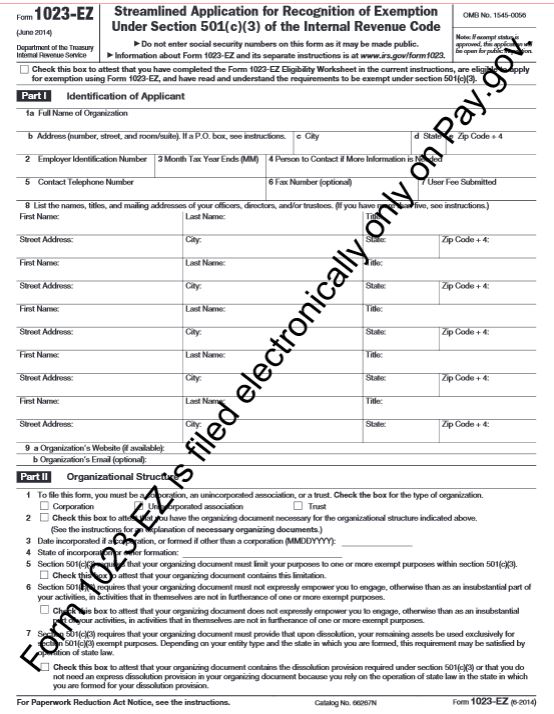

Greetings, I’ve started a Classical Conversations Community in Washington state. To be able to host my community at my church, we were asked that we create a non-profit organization so I did. I created a separate non-profit banking account from…

I have been a director of a homeschool educational group (Classical Conversations) as an individual DBA. I have been paid but the money goes back into paying others for my kids’ education and materials for the group – generally no…

Leaders of a nonprofit should be motivated by a desire to serve their community of homeschooling families in a good and responsible manner.

The IRS is looking at nonprofit organizations who convert from for-profit businesses and misclassify workers.

Here are the top tax mistakes homeschool for-profit directors and owners make.

There's a new tax deduction for business owners in 2018!

The ebook Taxes for CC Licensed Directors is now available

The tuition and fees are required, so can they be considered a business expense?

A homeschool business owner asks, "Why do I have to claim all of the money even though I don’t keep it?"