Can my landlord get a tax deduction for the free rent he gives us?

Can a landlord can claim a deduction for the reduced rent she gives to a homeschool group?

Can a landlord can claim a deduction for the reduced rent she gives to a homeschool group?

Helping homeschool leaders understand how to classify their workers correctly as employees or independent contractors.

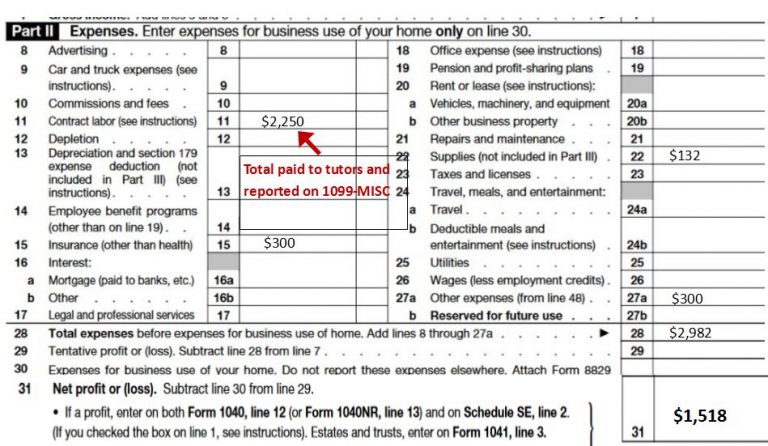

A new Classical Conversations Director asks how to report her income and expenses on her tax return.

Helping homeschool leaders know what to do if their organization has lost its tax exempt status.

A report that the IRS requires from all tax exempt organizations--including your group! It's called the Form 990.

Some homeschool groups look a lot like schools. They offer a full curriculum, there are teachers teaching classes, they rent space to conduct the classes, etc. So is a homeschool program a school? I’m a CPA, so I tend to…

It’s easier than ever to get tax-exempt status. Should your group apply?

What does it take to be a nonprofit? Only two things!

I have spoken to several Classical Conversations (CC) Directors lately who tell me that they gave themselves a 1099-MISC to report what they paid themselves.

In 2016 I took a break from podcasting, but now I’m back with a different format. The podcast will be focused on helping homeschool leaders and businesses run their programs legally and successfully. The podcast episodes will be shorter–15…