Compensating board members can be troublesome!

A homeschool organization can compensate your board for their service, but compensation to officers is taxable income and the board members must be paid as employees.

A homeschool organization can compensate your board for their service, but compensation to officers is taxable income and the board members must be paid as employees.

A homeschool support group knows it needs to file an annual report with the IRS but how?

Does your homeschool board lack direction and forward thinking?

Homeschool co-ops should be giving Form 1099MISC to their paid teachers.

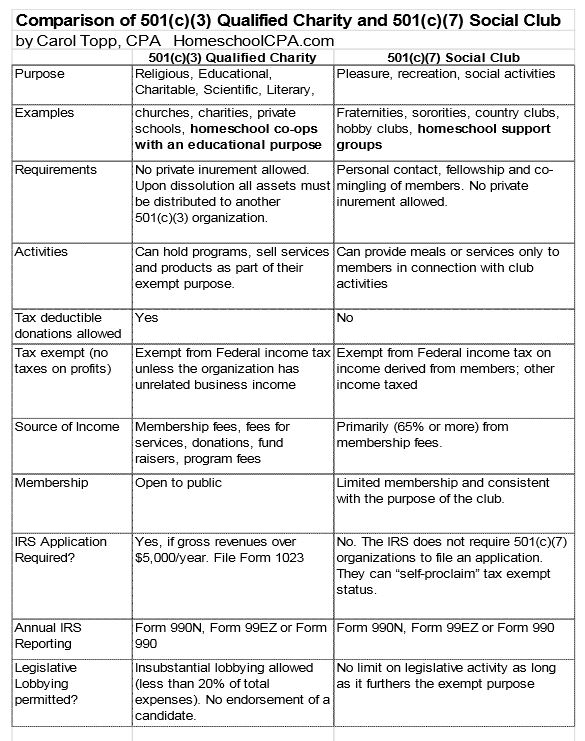

One difference between a homeschool co-op and support group is their tax exempt status in the eyes of the IRS.

Homeschool leader is uncomfortable about putting her Social Security Number on her co-op's EIN application.

Get a free copy of QuickBooks 2015 Premiere Nonprofit software package.

I am pleased that HomeschoolCPA.com is named on of the 50 Best Accounting Blogs for 2014.

Congratulations to Christian Homeschool Organization Interact Connect Encourage (CHOICE) in South Carolina on recently receiving 501(c)(3) tax exempt status with the IRS.

A homeschool leader wonders if getting a new id number from the IRS will solve his problems.