IRS reports your homeschool group needs to file every year

Your homeschool group should be filing some reports every year with the IRS. Did you know that?

Your homeschool group should be filing some reports every year with the IRS. Did you know that?

A homeschool leader is given thousands of dollars in gift cards and free tuition each year. Are these gifts or taxable compensation?

A homeschool organization can compensate your board for their service, but compensation to officers is taxable income and the board members must be paid as employees.

A homeschool support group knows it needs to file an annual report with the IRS but how?

Homeschool co-ops should be giving Form 1099MISC to their paid teachers.

Homeschool leader is uncomfortable about putting her Social Security Number on her co-op's EIN application.

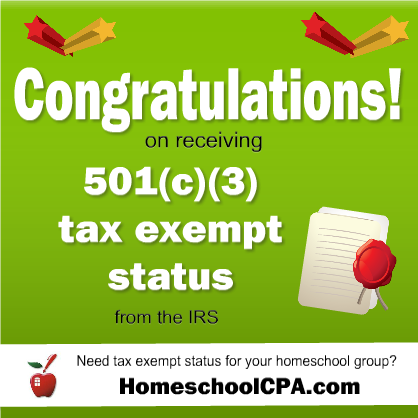

Congratulations to Christian Homeschool Organization Interact Connect Encourage (CHOICE) in South Carolina on recently receiving 501(c)(3) tax exempt status with the IRS.

A homeschool leader wonders if getting a new id number from the IRS will solve his problems.

The IRS is getting faster at approving 501(c)(3) tax exempt status for small nonprofits.

Do you know the pros and cons of 501(c) tax exempt status? Do you know what tax exempt status could mean for your homeschool group?