We are a new Classical Conversations community set up as a single member LLC. We only had 2 students and so my tutor’s income was below the requirement for filing 1099s. Same for me. However, I saw that I shouldn’t be filing a 1099-NEC for myself. What should I be doing?

And what is considered profit for a CC community?

Esther

Thank you for emailing me your question about taxes and your Classical Conversations (CC) business.

As a single member LLC, you are a sole proprietorship and you report your income and expenses from your CC business on a Schedule C Profit or Loss from Business as part of your Form 1040.

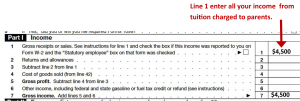

All your income from the tuition and fees charged to your customers (i.e. parents) goes on line 1 Gross receipts or sales. In this example the total income is $4,500.

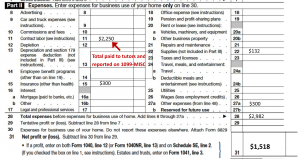

Your payment to your teacher(s) goes on Line 11 Contract Labor. In this example a total of $2,250 was paid to independent contractors. Other expenses go in the categories listed in Part II of the Schedule C. Other expenses made the total expenses sum to $2,982 as shown on Line 28.

The profit is shown on Line 31. It is calculated from Gross Income (Line 7 on the form) minus Expenses (Line 28). The profit is what you get to keep (and pay taxes on!) as the business owner. In this example the profit is $1,518. This amount will carried forward to the Form 1040.

There is a lot to learn about running a business. I have a webinar and ebook to help you understand the tax implications:

The ebook Taxes for Homeschool Business Owners is a great resource for:Tutors or teachers for a homeschool program paid as an Independent Contractor, Classical Conversations(R) Directors, CC tutors’ Coaches, musicians, artists, etc. hired to teach at a homeschool co-op

My webinar Tax Preparation for Homeschool Business Owners should be a lot of help to tutors, non-employee co-op teachers and other homeschool business owners! You can watch the recording at HomeschoolCPA.com/HSBIZTAXES for a small fee of $10.

P.S. I am no longer preparing tax returns, so I recommend you find a local CPA to help you in preparing your tax return. To find a local CPA or accountant I recommend you try Dave Ramsey’s Endorsed Local Providers and Quickbooks Proadvisors. A lot of CPAs and accountants listed on these sites specialize in small businesses.

I am a CC director. I am not sure what is the best option when it comes to register ou r community. A LlC or as a Sole Propertor? Thank you so much for your help.

Maria, by default if you are the only owner you are a sole proprietor. You could consider adding LLC status to your sole proprietorship business if you want the limited liability protections tha LC status offers. IOW, LLC status can be added later. I ran my accounting business for 3 years and then added LLC status. I recommend that you read up on LLC status and what is required in your state. Some states charge a one-time fee, some charge a yearly fee.