I have been a director of a homeschool educational group (Classical Conversations) as an individual DBA. I have been paid but the money goes back into paying others for my kids’ education and materials for the group – generally no profit. It is not an LLC or corporation. Can I incorporate in the state and file the IRS Form 1023-EZ form?

Jodi

Jodi,

Even though your CC business was not profitable, it was still a business. Having no profit does not make your business a properly formed nonprofit organization. To be a legitimate nonprofit organization you need a board, bylaws, and nonprofit mission.

By the way, your children’s tuition and homeschool expenses are not a business deduction on your tax return. So you may have been profitable from a tax perspective after all. See my ebook Taxes for Homeschool Business Owners for details on what are tax deductible expenses.

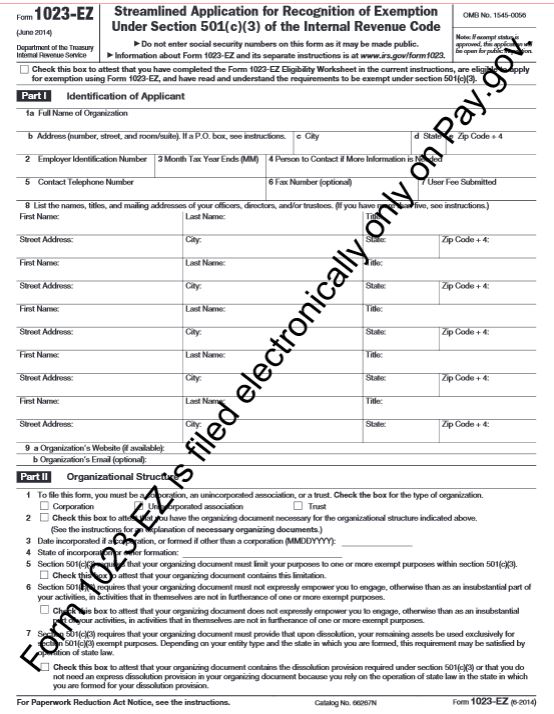

Therefore, you can convert your business to a nonprofit organization, but you will not be able to use the shorter, online IRS Form 1023-EZ to apply for 501c3 tax exempt status.

The Form 1023-EZ specifically asks if the nonprofit organization is a “successor to a for-profit business.” The newly formed nonprofit would be a successor to your business because most of the assets or activities are taken over by the nonprofit.

So you must file the IRS full version Form 1023 to receive tax exempt status for the newly formed nonprofit organization. The IRS will request an explanation of your prior business and how the nonprofit is different from the business on Schedule G Successors to Other Organizations.

I addressed this specific situation in my first webinar of this series on Create a Nonprofit for Your Homeschool Community. You might find it very helpful to decide if you want your CC Community to convert to a nonprofit. I discuss the difference in mindset, setting up a board, and more.