File your IRS 990-N for prior years

List of IRS approved providers for filing prior year Form 990N

List of IRS approved providers for filing prior year Form 990N

You'll find a collection of links on the Help for Homeschool Leaders board on Pinterest.

A homeschool leader wonders if his 501c3 organization can lobby against legislation harmful to homeschooling.

A homeschool leader wonders what to call a co-op teacher who is not hired by the co-op.

Does your homeschool group suffer from a dominate leader? She may have founders syndrome.

Many homeschool groups have dominate leaders that suffer from founders syndrome. Here's how to spot it.

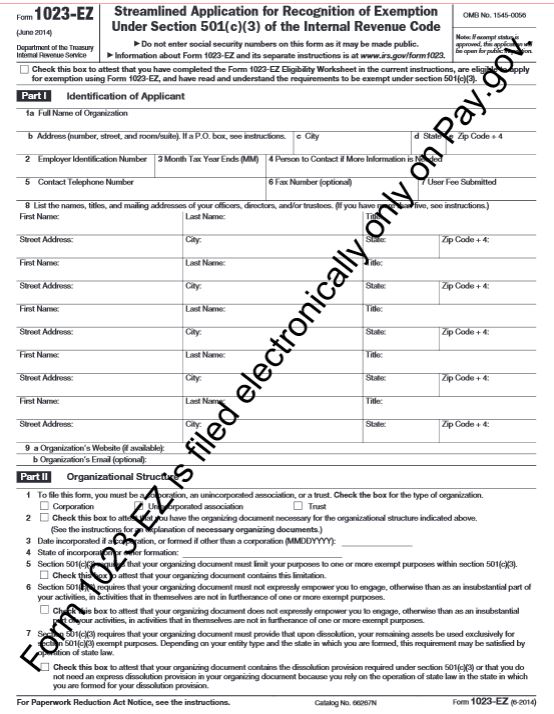

This new IRS form will make applying for tax exempt status much easier for small nonprofits.

What to do if your church-host requires insurance from your homeschool group

A homeschool organization wishes to set up a scholarship fund. Here's what they need to do.

Did your nonprofit organization lose your tax exempt status? What’s this all about? In 2010, the IRS has begun revoking the tax-exempt status nonprofit organizations that failed to file a Form 990/990EZ or 990N for three years. A large number…