Obtaining the EIN number seems easy enough. There is only one problem. We are apprehensive about using any one of our personal Social Security Numbers in order to obtain it. What about when the group’s president changes, do we then need to refile for a new EIN with a different Social Security Number? Is the person who requests the EIN number with their Social Security Number under any obligation to the IRS?

Shannon in PA

Shannon,

Yes, you need an EIN for banking purposes. The IRS began asking for Social Security Numbers on EIN applications in 2000. This was to confirm that there really is a human being behind the organization and that the organization getting an EIN is not a sham.

The person requesting the EIN is called the “responsible party,” by the IRS, but this is no different from being an officer on the board. The IRS just needs to know who in one of your leaders, again to assure that there are human beings running this group and it’s not a fake organization.

You do not have to apply for a new EIN just because of a switch in officers. Nonprofits change leadership frequently.

You can have the responsible party’s name on the EIN replaced with the new name by filling out IRS Form 8822-B

You change the responsible party (the person whose name and SSN are associated with your EIN) by filing IRS Form 8822-B.

I hope that helps!

Carol Topp, CPA

HomeschoolCPA.com

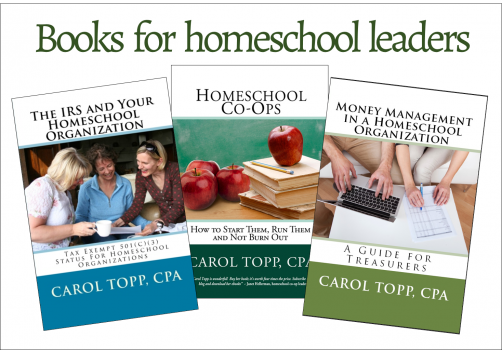

Need help understanding tax exempt status or money management in your homeschool group?

Carol Topp’s books are written specifically for the homeschool leader.