***UPDATE December 23, 2022****

The IRS has delayed implementation of the reduced threshold of $600 for third party payment processors to send Form 1099-Ks to payees.

“The IRS and Treasury heard a number of concerns regarding the timeline of implementation of these changes under the American Rescue Plan,” said Acting IRS Commissioner Doug O’Donnell. “To help smooth the transition and ensure clarity for taxpayers, tax professionals and industry, the IRS will delay implementation of the 1099-K changes. The additional time will help reduce confusion during the upcoming 2023 tax filing season and provide more time for taxpayers to prepare and understand the new reporting requirements.”

https://www.irs.gov/newsroom/irs-announces-delay-for-implementation-of-600-reporting-threshold-for-third-party-payment-platforms-forms-1099-k

I’m glad to hear this news. The new threshold was creating a lot of confusion and received a lot of criticism. It is unclear when and if the IRS will enforce the new $600 threshold. There have been requests to set the threshold at $5,000 or even $10,000. We’ll wait and see!

So homeschool groups have another year to make sure their Paypal, Venmo, etc. accounts are set up using the organization’s name and EIN, not an individual’s name and SSN. Read on....

Lots of homeschool groups use Paypal, Venmo, Stripe, Square, etc. and other third party payment processors to collect dues and fees. That’s a great way for your group’s families to pay the organization easily.

For 2022, these third party payment apps will start sending everyone who receives more than $600 though their service a tax form called a 1099-K and a copy goes to the IRS. This means that your homeschool group will receive a 1099-K in early 2023(now updated to 2024) showing all the funds (if greater than $600 in the previous calendar year) that flowed through Paypal, Venmo, etc. and a copy goes to the IRS!

Here’s the law itself (scroll to page 94 of the 114 page pdf). It is part of the American Rescue Plan Act of 2021. The new rule is effective beginning on January 1, 2022. President Biden signed the law with the threshold amendment in March 2021.

***Update December 23, 2022: The new rule has been delayed for a year***

What to do with a 1099-K when it comes?

If your organization is a tax exempt, nonprofit AND your payment account is set up under the organization’s name AND uses the organization’s EIN (Employer Identification Number) as their tax ID, you have nothing to worry about!

You should simply give the 1099-K to the treasurer or your bookkeeper and she should check the amount for accuracy. Then file it away. Your tax exempt organization should be filing an annual IRS Form 990/990-EZ/990-N with the IRS every year. The amounts on the 1099-K will be included in the total revenues on this 990 Information return. But you will not owe additional tax on this money, because your organization has tax exempt status. 🙂 The IRS Form 990/990-EZ/990-N are information returns for tax exempt organizations, not tax returns.

How do I know if my Paypal, Venmo is in the organization’s name?

Log onto your third party payment processor. Go to Settings>Account Information and click around until you find a Tax ID section or Identity Verification (on Venmo). Also look for Account Type. In PayPal and Venmo you should have a Business Account, not personal account for your homeschool group.

How do I know if my group is a tax exempt nonprofit?

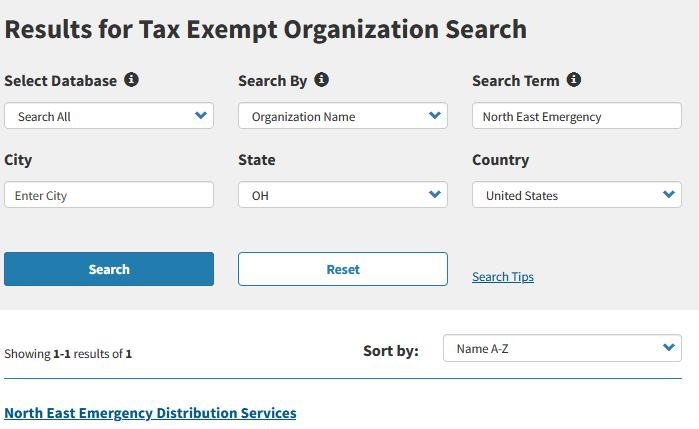

Look up your organizations name in the IRS Exempt Organization database. https://apps.irs.gov/app/eos/

Here’s an example from a charity I serve as treasurer:

When I click on the hotlink of the organization’s name I learned a few more details and see that this organization is update date with filing annual IRS reports.

If your organization is not listed or it says Revoked with a date, your homeschool group is not tax exempt and must correct that immediately. Start by reading the blog posts and to apply for tax exempt status or get tax exempt status reinstated if it expired.

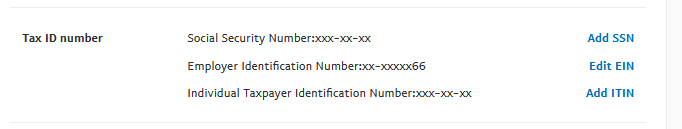

How do I know if we are using the organization’s EIN as our tax ID?

Log onto your third party payment processor. Go to Settings>Account Information and click around until you find a Tax ID section or Identity Verification (on Venmo). In PayPal and Venmo you should have a Business Account, not a personal account for your homeschool group.

What if our Paypal account is a person’s name?

Well, now you have a problem! Paypal (I’m using Paypal generically to mean any payment processor) thinks this account belongs to an individual and he or she will get the 1099-K. A copy goes to the IRS and the IRS will expect to see this money reported on that person’s individual tax return! Expect to get a panicked call from this individual! She will probably have to hire a professional tax preparer to help her report this money (which is not really hers) and deduct any expenses, so she avoids a large tax bill. She will be very unhappy with your organization!

Thanks to a member of the Homeschool Leader Facebook Group, Angie C. who called Paypal and shared this:

“I just got off the phone with a PayPal rep. He said that nonprofits have to have the SSN of the business representative in order to prove US citizenship. If a 1099-K is issued, it will go to the business and address associated with the EIN. If the EIN is invalid for whatever reason, the 1099-K will go to the SSN on the account.”

How to check your Paypal account: In Paypal go to Account Settings>Business Profile> Account Owner Information. Look under the Tax ID. There should be a number for the EIN.

If your Paypal account is in someone’s SSN, without any EIN, change that immediately. You may need to contact Customer Service. They will want verification of your EIN (the IRS letter you received when you applied for your EIN) and perhaps other documents such as proof you are a nonprofit and tax exempt with the IRS. If you do not have these documents, Paypal will likely close your account. So empty the cash first and create a new Paypal account under the name and EIN of your organization.

Here’s what to do NOW in the last weeks of 2021:

- Log onto all your third party payment processors (Paypal, Venmo, Zelle, etc). Verify that all the accounts are in the name and EIN of your organization. Verify that the address is up to date too. Take screen shots and save them permanently.

- Fix any incorrect information on the third party processor accounts. Take screen shots and save them permanently..

- Call the third party processor customer service if you have any problems updating your information online.

- Don’t have tax exempt status? Contact NonprofitElite.com or one of HomeschoolCPA’s Recommended Consultants to apply for tax exempt status. Start by reading these blog posts:

Carol Topp, CPA

HomeschoolCPA.com