Carol,

I will be a director with Classical Conversations (TM) for the upcoming year and I wanted to keep track with all finances and stay on top of all the things for taxes but I am unsure of how to do that or find someone knowledgeable with something like Classical Conversations.

Would you be able to direct me in a better direction with things?-Jillian M

Jillian,

Good for you to realize that directing a Classical Conversation program is a business and you need to be concerned about taxes and record keeping. Sadly, I have heard from many CC Directors that they had no idea they were running a business. Some have made terrible mistakes in their tax filings.

I have several resources for you:

Taxes for Homeschool Business Owners

The ebook is 60 pages long and contains information on

- Business Start Up

- LLC status

- Tax Deductions

- Tax Forms

- Sample Tax Returns

- Self Employment Tax

- Paying Yourself

- Paying Others

- Businesses Using Churches

- Should My Homeschool Program Be a Nonprofit?

Business Q&A for CC Directors: Answers You Need to Run Your CC Business

This 50 page ebook is a collections of questions CC Directors have asked the HomeschoolCPA, Carol Topp, CPA over the past few years. Carol answers each question and cover topics such as:

- Business Set up: LLC status, nonprofit, ministry or business, checking accounts, record keeping

- Relationship with your church-host: taxes for the church

- Taxes: What forms to file, 1099-MISC, tax deductions

- Employees: Independent Contractor or employee

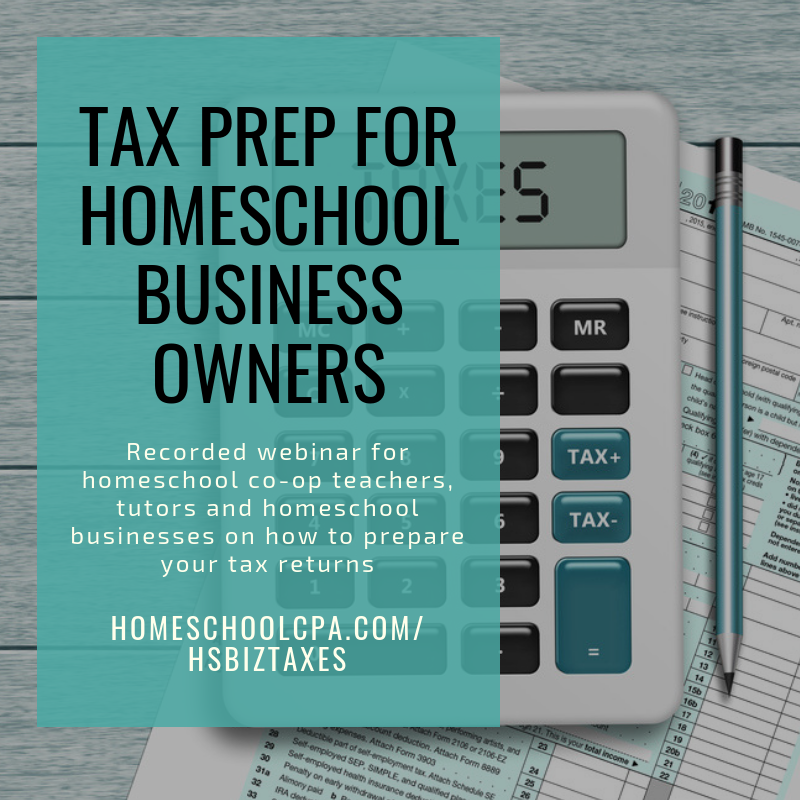

I hosted a webinar on Tax Preparation for Homeschool Business Owners. It should be a lot of help to you as a CC Director. You can watch the recording at HomeschoolCPA.com/HSBIZTAXES for a small fee of $10.

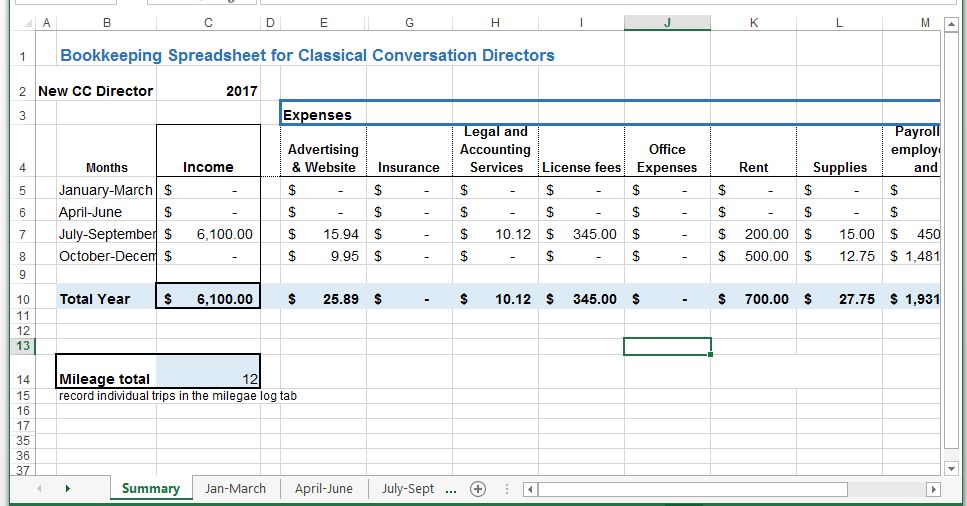

Bookkeeping spreadsheet for CC Directors is a free download.

I hope that helps!

Carol Topp, CPA

HomeschoolCPA.com

Helping homeschool leaders