Classical Conversations directors and tutors have asked me lot of questions about their taxes. Things like:

- What tax form should I to use to report my income and expenses?

- What expenses were tax deductible?

- What tax forms do I need to give to my tutors?

- How should tutors be paid?

- How do I pay myself as a CC Director?

To help these CC Directors, I have compiled several resources including an ebook, webinar, blog posts and record keeping spreadsheet.

I recommend these blog posts:

CC Directors: Do not give yourself a 1099-MISC

Tax return for a Classical Conversations homeschool business

I’m a Classical Conversations Director. Do I have to file any forms with the IRS?

Understanding Taxes for a small homeschool business

Ebook: Taxes for Homeschool Business Owners

In 2018, I wrote an ebook Taxes for Licensed Classical Conversions Directors. It was supposed to be distributed by Classical Conversations, Inc to all their Directors. That ebook is no longer available.

So I rewrote and expanded it to become Taxes for Homeschool Business Owners. It is more up-to-date than the other ebook since there were major changes in the tax laws and forms in late 2018.

Tax Prep Webinar

There is a lot to learn about running a business. I don’t mean to discourage you or anyone else away from operating a homeschool business. You provide a valuable service to homeschool families! This webinar will help you understand the tax implications:

Tax Preparation for Homeschool Business Owners will be a lot of help to tutors, non-employee co-op teachers and other homeschool business owners! You can watch the webainr at HomeschoolCPA.com/HSBIZTAXES for a small fee of $10.

Carol, thank you again for the webinar. It was one of the BEST webinars I’ve EVER attended. If you do hold another one, I would pay for it hands down. Totally worth the $10!“ -Denise, webinar attendee

“I actually don’t care for webinars at all – it is not my learning style at all and I struggle to focus, but this one was extremely value and had my attention”. -Mary, webinar attendee

Get Professional Tax Help

Consult a local, small business CPA. To find a local tax preparer I recommend two sources:

- QuickBooks Pro Advisor at https://quickbooks.intuit.com/find-an-accountant

- Dave Ramsey Endorsed Local Provider at https://www.daveramsey.com/elp/tax-advisor

Both of these websites allow you to search for a local tax preparer who is knowledgeable about taxes for small sole proprietor businesses.

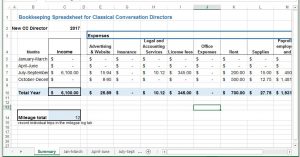

Free Record Keeping Resource

A bookkeeping spreadsheet for CC Directors. You can get the spreadsheet now (all it costs is your email!)