Carol,

I am wondering if we can get some clarification from you. I am looking through this IRS document we received after we reapplied for 501c3 tax exempt status per your direction back in January.

It says we have been determined to be a 501(c)(3) private foundation and are required to file a 990-PF.

I feel like this information is incorrect, am I right in thinking this?

Thank you,

Ashley

Ashley,

Oh dear. This is very unfortunate.

I guess that whoever filled out the 1023-EZ checked the box saying your homeschool group was a private foundation rather than a public charity.

Almost all homeschool organizations are public charities not private foundations.

What’s a private foundation?

Private foundations are funded by an individual, family, or a corporation, like the Bill and Melinda Gates Foundation or the Ford Foundation.These individuals and corporations typically make large donations to the foundation. The foundation invests the donations. The goal of the foundation is to distribute the income from their investments to charitable works like universities or medical research.

So what’s a public charity?

On the other hand public charities are funded by the general public through donations, membership fees, or activities related to their exempt function.

Most homeschool organization receive their funds from membership fees, tuition, field trip fees, and class fees. They are not private foundations.

Almost all homeschool programs are public charities.

Why does it matter?

There are several reasons why being classified as a public charity rather than a private foundation is important:

- Private foundations must distribute their income from their investments every year or pay taxes. In addition, private foundations must pay an excise tax on net investment income.

- The annual report for a private foundation is the complex, multi-page form called the 990-PF. It will take a CPA to help you prepare this beast of a form. But small public charities can file the IRS Form 990-N electronically every year by themselves!

- Dissolving a private foundation involves either paying an IRS fee or distributing the funds to another established private foundation. it’s complex to dissolve a private foundation and will probably require an attorney and a CPA.

- Private foundations must to make public their list of contributors; pubic charities do not have to make their donor list public.

- Private foundations are highly regulated by the Tax Code and subject to a host of technical rules and restrictions that do not apply to public charities.

The cause of the mistake

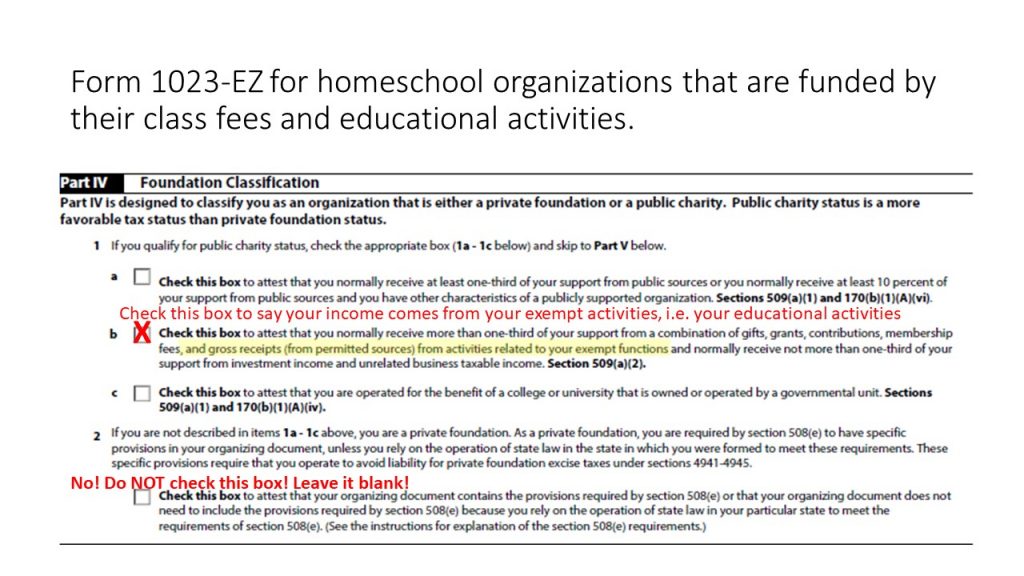

Here’s a snapshot of the Form 1023-EZ application for 501c3 status where a homeschool organization tells the IRS how it receives its funding.

The homeschool program that emailed me checked the wrong box on the Form 1023-EZ and said they were a private foundation when they are not.

How to avoid this mistake

This mistake could have been avoided.

I offered my services to help this homeschool group with the Form 1023-EZ While my fee is $300, I also pointed the leaders to a $25 webinar where I go though the Form 1023-EZ line-by-line and I explain the difference between public charity and private foundation.

This homeschool group never purchased my services or even my webinar, thinking they could save time and money. 🙁

The webinar on 501c3 Application for Homeschool Nonprofits costs only $25. In addition to the 90 minute webinar, you get a copy of my ebook The IRS and Your Homeschool Organization.

How to fix the mistake

To request the IRS change the status of Ashley’s homeschool program from private foundation to public charity, it must file IRS Form 8940. The form looks easy, but it is all the supporting documents and the explanation to the IRS that are the quite complex and burdensome.

Ashley will need to give the IRS a lot more documentation including bylaws and financial statements than she did when filling the Form 1023-EZ application.

I will charge Ashley’s organization $200 to request a change to public charity with the IRS on Form 8940. The IRS fee is an additional $500.

So a $700 expense could have been avoid by paying $25 and watching my webinar!

Don’t make the same mistake!